Start your application below

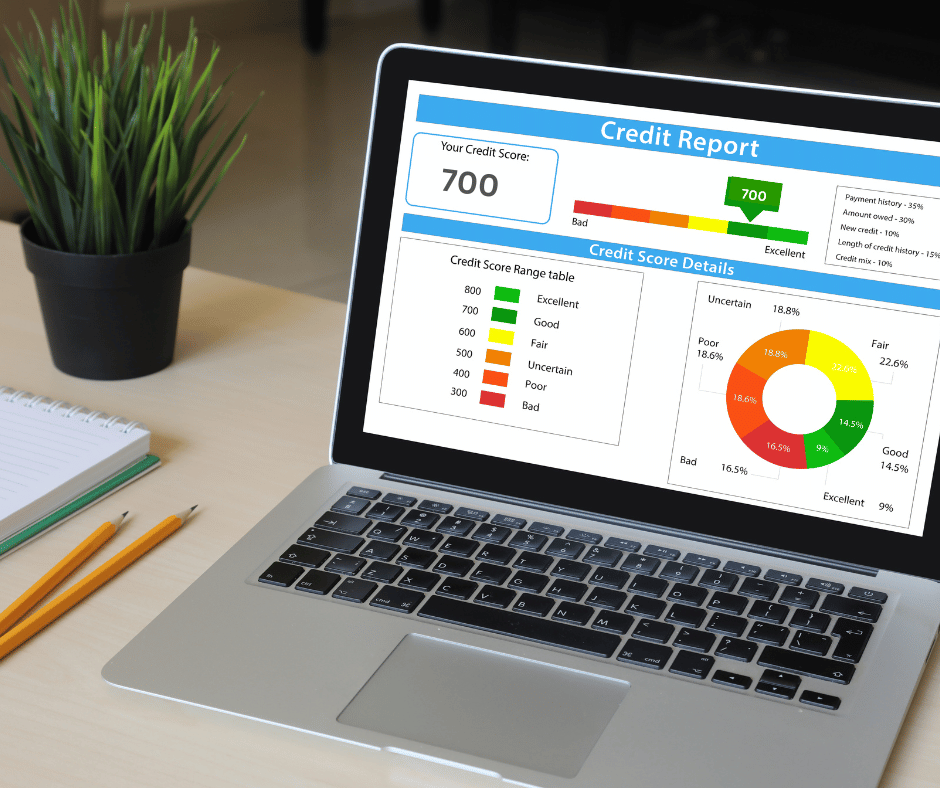

With some basic information from you, our system will pull a "SOFT" credit report that does NOT affect your credit scores or trigger an inquiry. This Credit Score and Income information is then calculated using our affordability program to maximize funding capability and will show us how much you qualify for using multiple different types of funding solutions!

We use this data to arrange, negotiate and close multiple loans, therefore giving you the ability to have multiple options and give you the total amount of funding you need!

A funding Consultant will contact you within 24 business hours to discuss your pre-approval and next steps.

There is no upfront out of pocket expense to obtain the funding you need!

Through our funding consultations, we arrange and guide you through the application process to eliminate any upfront cost, reduce application errors and maximize your "fundability" with the least amount of impact to your credit. We know who reports, when they report, what to put on applications and when to submit applications. This takes all of the guess work and heavy lifting out of your new Business Start Up process!

Rates and terms are defined by the lenders in our network and based on variables included on your credit.

Standard industry rates for Term Loans range from 7.9% to 17.9% and terms from 2-12 years. (these are subject to change with economic fluctuations) You will know all rates and terms of each loan prior to accepting them.